Getting Started with Klavena Integration

Before analyzing your financials, make sure you’ve connected your sales channels to QuickBooks Online via Klavena.

Follow our guide:

👉 Welcome to Klavena: Your First Steps

📊 Key Financial Reports in QuickBooks Online

QuickBooks provides multiple financial reports that help you understand your business performance. The two most important for e-commerce businesses are:

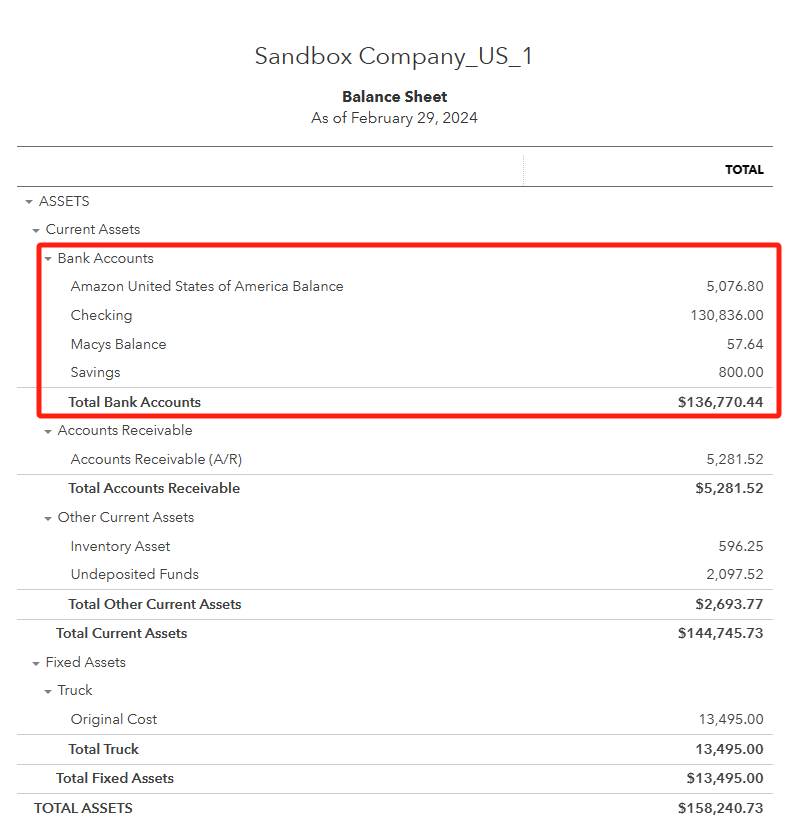

1. Balance Sheet

The Balance Sheet is a snapshot of your business’s financial position at a specific point in time. It lists your assets, liabilities, and equity.

How Klavena Helps:

- Tracks marketplace balances as separate bank accounts (e.g., Amazon, Walmart).

- Even before payout, marketplace-held funds are counted as assets—because they are owed to you.

- Tracks inventory value (if inventory tracking is enabled).

✅ Example: In QuickBooks, Klavena creates a “bank account” for each marketplace. When a payout happens, you simply record a transfer from the marketplace account to your real business bank account.

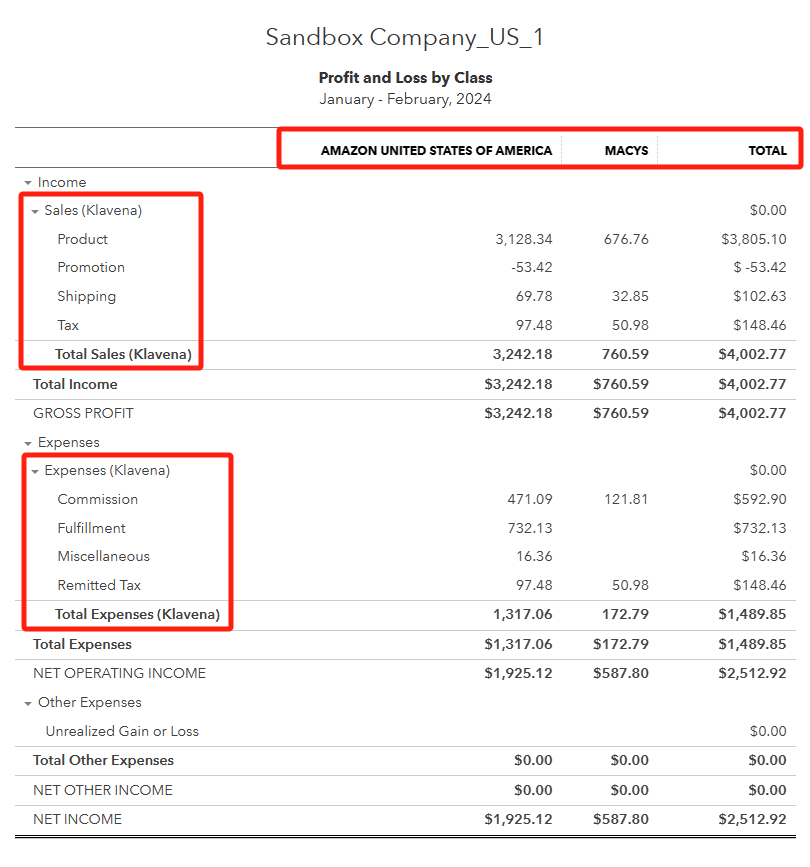

2. Profit & Loss (P&L) Statement

Also called the Income Statement, this report shows your revenue, expenses, and profit over a given time period.

How Klavena Helps:

- Categorizes income into accounts like:

Product Sales,Shipping Income,Tax Collected,Promotions, etc. - Categorizes expenses into accounts like:

Commission,Fulfillment,Storage Fees,Advertising,Remitted Tax.

✅ Tip:

If you're on QuickBooks Online Plus or Advanced, use the Profit & Loss by Class report to view profitability per sales channel (e.g., Amazon vs Shopify). Otherwise, use the regular P&L report.

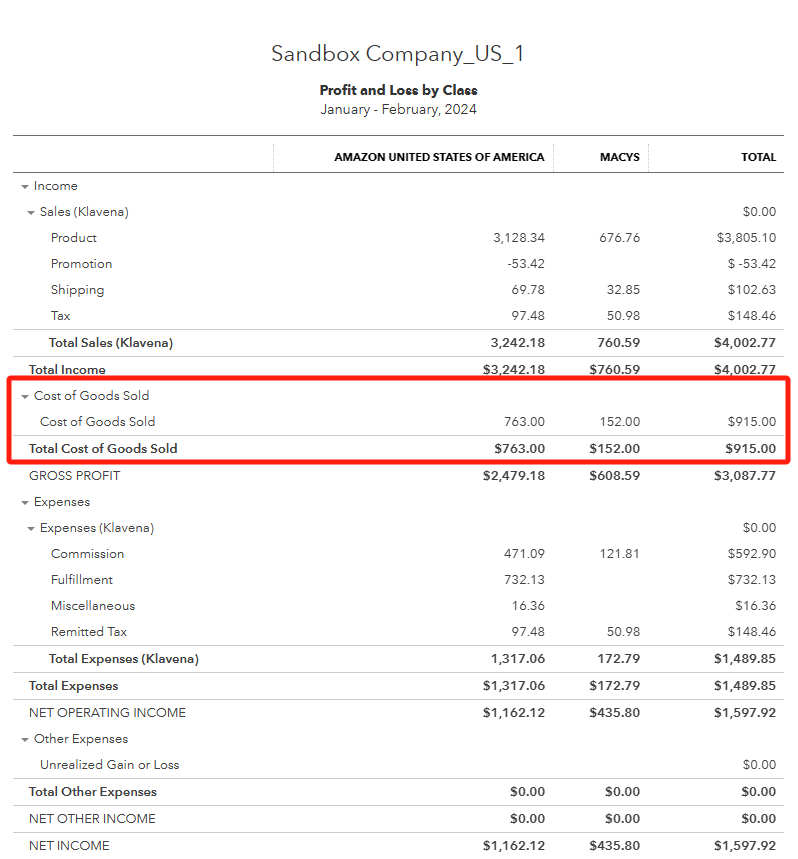

🧮 Enabling Inventory Tracking to View Cost of Goods Sold (COGS)

By default, QuickBooks does not show COGS in your P&L even if you’ve entered purchase transactions. This is because:

- COGS is only recorded when the item is sold (accrual method).

- QuickBooks can’t determine COGS unless inventory tracking is enabled.

📌 Steps to Enable COGS Tracking:

- Follow this guide to set up inventory tracking in Klavena and QuickBooks.

- Undo and re-import your existing settlements so that inventory data is included.

- After setup, your updated P&L report will now include COGS.

✅ Example:

Once inventory tracking is active, QuickBooks will subtract your cost of goods from revenue—giving you gross profit automatically.

💡 Summary: How Klavena Helps You Understand Your Financials

- Balance Sheet:

Shows what your business owns and owes at a specific point in time.

With Klavena, you can track:- Cash in your real bank accounts

- Funds held in sales channels (like Amazon or Walmart) as virtual bank accounts

- Inventory value (if inventory tracking is enabled)

- Cash in your real bank accounts

- Profit & Loss (P&L) Statement:

Displays your revenue, expenses, and profit over a given time period.

Klavena organizes this by:- Categorizing income (product sales, shipping, taxes, etc.)

- Categorizing expenses (commissions, fulfillment, advertising, etc.)

- Segmenting performance by sales channel (with QuickBooks Online Plus or Advanced)

- Categorizing income (product sales, shipping, taxes, etc.)

- COGS and Inventory Tracking:

To see Cost of Goods Sold (COGS) and gross profit in your P&L:- Enable inventory tracking in Klavena and QuickBooks

- Re-import settlements after setup

- QuickBooks will now automatically calculate and display COGS based on actual sales

- Enable inventory tracking in Klavena and QuickBooks