Why Inventory Tracking Matters

With inventory tracking enabled, QuickBooks Online can calculate your cost of goods sold (COGS) every time a product is sold. Without inventory tracking, QuickBooks has no way of knowing how much each unit cost, which means your gross profit and financial reports will be incomplete.

By default:

- Without inventory tracking, Klavena assigns all sales and refunds to a generic non-inventory item named “Product.”

- With inventory tracking, Klavena maps each sale and refund to the specific inventory item in QuickBooks, allowing QuickBooks to reduce inventory levels and calculate COGS automatically.

How QuickBooks Calculates COGS (FIFO Method)

QuickBooks Online uses the First-In, First-Out (FIFO) method to track COGS. This means that the oldest inventory purchases are the first to be counted as sold. For each sale, QuickBooks reduces inventory and calculates the cost based on your earliest unsold inventory.

Klavena handles the sales side by creating sales receipts tied to inventory items. You are responsible for recording your purchase transactions in QuickBooks, so the system knows your inventory costs.

Feature Availability

Inventory tracking is only available on:

- QuickBooks Online Plus and Advanced plans

- The Klavena Professional plan

You must enable inventory tracking for each integration individually.

How to Enable Inventory Tracking

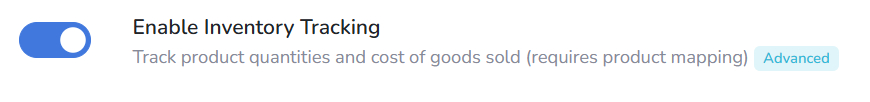

Step 1: Enable in Klavena

In the settings page of each integration, enable inventory tracking.

Navigate to Settings and Mappings.

Click Enable Inventory Tracking.

Step 2: Enable in QuickBooks Online

Go to QuickBooks → Settings → Account and Settings → Sales → and turn on Track quantity and price/rate and Track inventory quantity on hand

Mapping Error on Import

After enabling inventory tracking, your next settlement import may fail with a "mapping not found" error. This is expected until you map each sales channel product to its corresponding inventory item in QuickBooks.

Mapping Sales Channel Products to Inventory Items

- Create inventory items in QuickBooks (if not already created)

- Go to Products and Services.

- Click New and select Inventory.

- Enter the product Name (mandatory) and SKU (optional)

- Enter an Initial quantity on hand and the As of date (must be before your earliest sale).

- Save the item.

- Go to Products and Services.

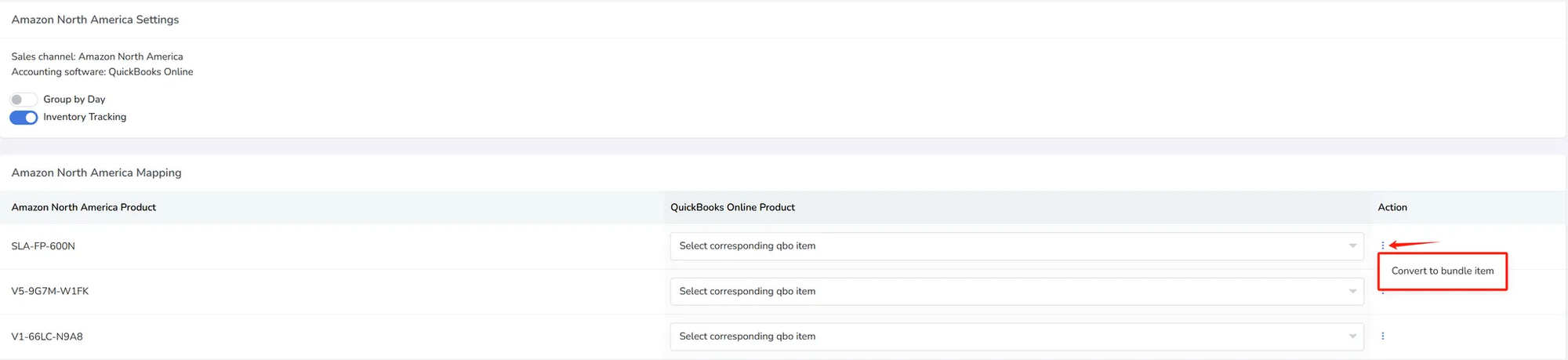

- Map products in Klavena.

- Return to the Mapping tab in Klavena’s integration settings.

- Match each product from your sales channel to the corresponding inventory item.

- Return to the Mapping tab in Klavena’s integration settings.

Bundles and Multipacks (optional)

If you sell bundles (e.g., a gift set with multiple SKUs) or multipacks (e.g. multiple of a single sku), you can break the bundle or multipack into its individual components and map each one in Klavena.

Here are some examples of situations in which you would want to use this feature.

- You sell a candle gift pack, containing 2 red candles, 2 green candles, and 2 blue candles, and you want to track the inventory and calculate cost of goods sold based on the individual red, green, and blue candles.

- Instead of selling 1 bottle of shampoo, you sell a multipack of 3 bottles of shampoo together, and you want to track the inventory and calculate cost of goods sold based on the individual bottle of shampoo.

To convert a mapping entry into a bundle mapping entry, navigate to the action menu, and click on “Convert to bundle item”. Don’t worry, you can always convert back to the simple mapping by clicking the action button “Convert to inventory item”.

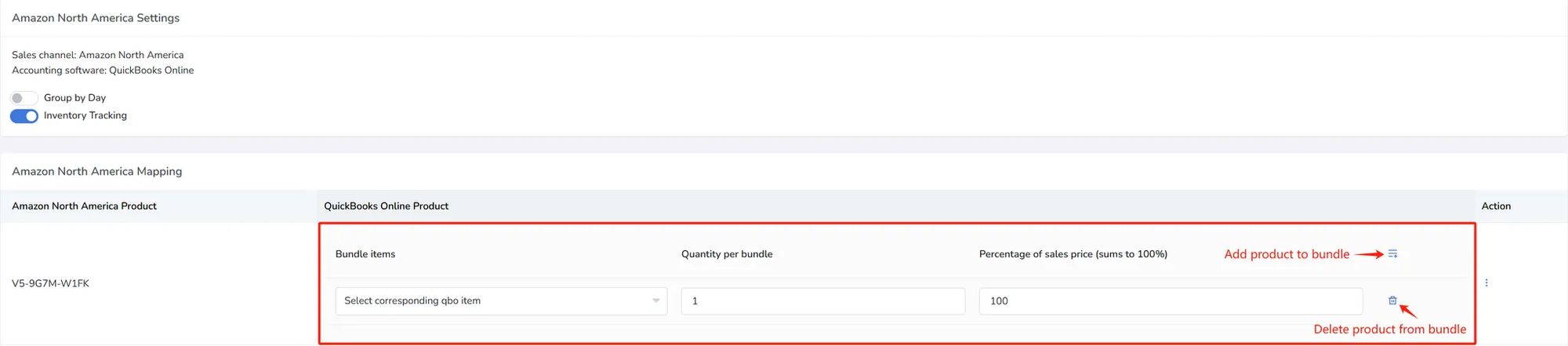

Next, you need to enter the following for your bundle or multipack:

- Bundle Item: The item within your bundle

- Quantity per bundle: Number of this item within your bundle

- Percentage of sales price: How much of the sales price should be allocated to this product within the bundle. This value must sum to 100 for all products.

Note: Percentage of cost is the total sales price allocated to that bundle item, not the unit sales price. For example: If 50% of sales price is allocated to this item, then no matter what the quantity per bundle is, that bundle item still gets 50% of sales price.

To add or remove objects from the bundle, you may click on the add or delete buttons on the right column.

Re-import the Settlement

After completing all mappings:

- Retry the previously failed import.

- Klavena will post sales receipts using the correct inventory items.

- QuickBooks will automatically reduce inventory and calculate COGS per sale.

Verifying Accuracy

After import:

- Open a recent sales receipt in QuickBooks to confirm it includes inventory items, not the generic "Product."

- Check your Profit & Loss and Balance Sheet reports — you should now see proper COGS and updated inventory asset balances.

Summary

- Inventory tracking is required for proper COGS reporting in QuickBooks.

- Klavena maps each transaction to inventory items so QuickBooks can perform FIFO-based COGS calculation.

- Setup involves enabling inventory tracking, creating inventory items, and mapping them properly.

- Bundles are supported either as single items or component SKUs.