The Problem

Ecommerce sellers often encounter the headache of bookkeeping for their business.

It's a hassle to parse through sales data and correctly categorize it for tax purposes or for general visibility into the business's financial health.

Some people may decide to use Excel to keep track, or they may choose to manually create the transactions in an accounting software like QuickBooks Online.

Either way, this is very error-prone, and it leaves much of the bookkeeping work to people who aren't familiar with the bookkeeping process, and to business owners who would much rather spend their time focusing on increasing revenues.

How does Klavena fit in?

- CPA-approved method to import sales data into QuickBooks Online. Hours will be saved monthly on bookkeeping, and tax season will be a breeze.

- Properly transform uncategorized sales, tax, refund, fee data into summaries that reconcile perfectly in QuickBooks Online

- Standardized format across all sales channels, so that you can easily compare them against each other.

- Automated sync that saves hours every month and eliminates the error-prone process of manual entry.

- Keeps track of inventory to allow automatic calculation of cost of goods sold (COGS) with QuickBooks' built-in first-in-first-out calculation.

- Scales with your ecommerce business to any number of orders.

- Sets up your accounting program with industry best practices of the accrual method of accounting and inventory tracking.

- As your ecommerce business scales to a certain size, the IRS dictates that your business must use the accrual method. It's better to get set up with best practices early.

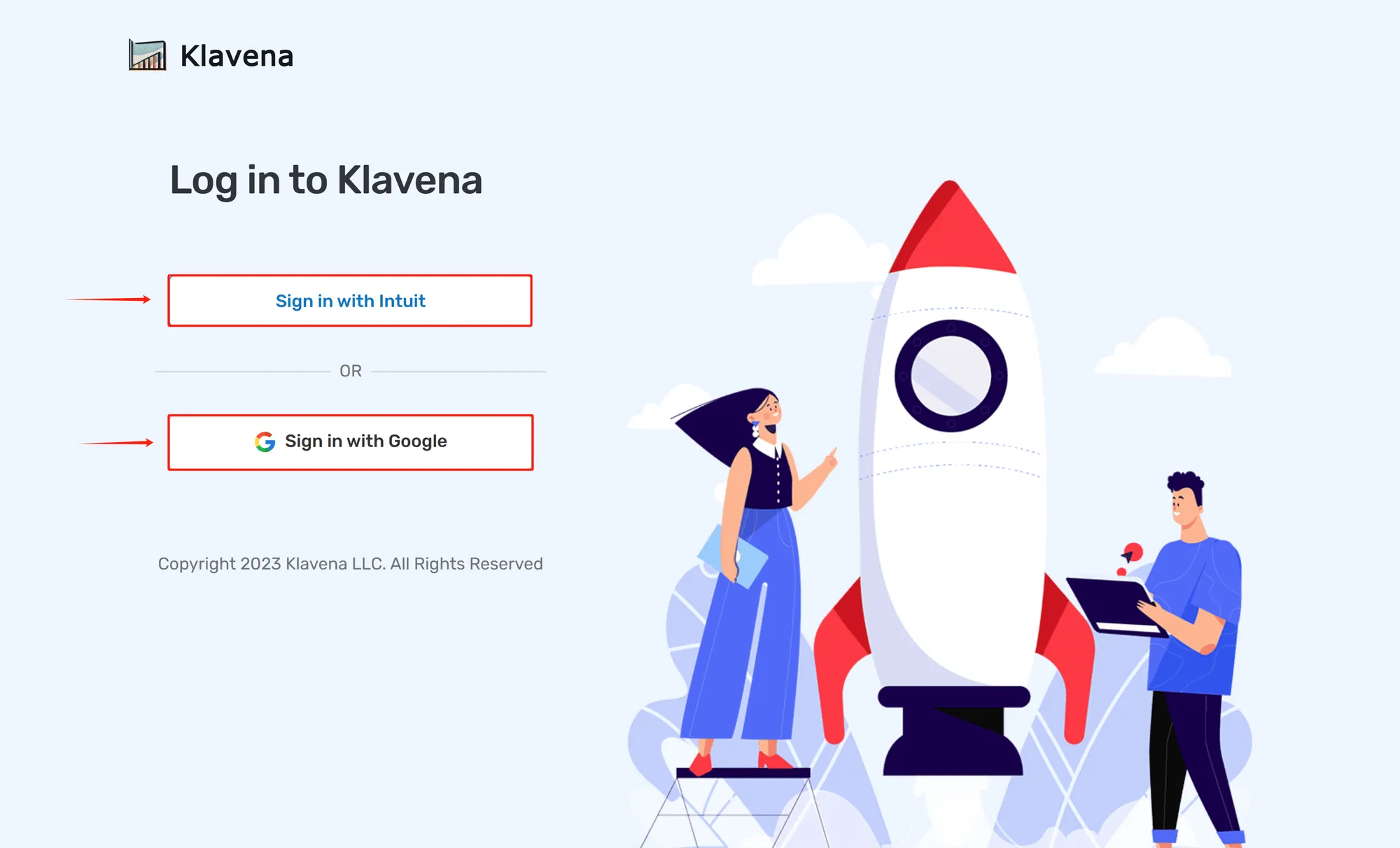

Sign in

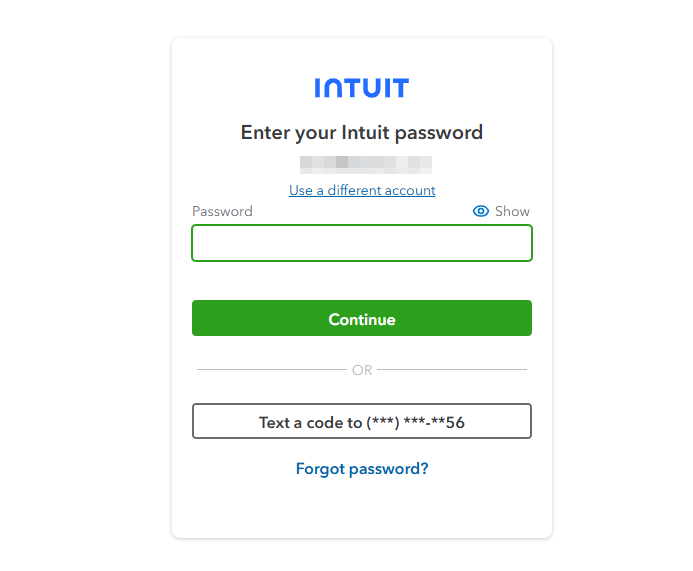

To get started with Klavena, you'll need to sign in through Single Sign On (SSO) with either Intuit or Google.

This will ask you for your respective Intuit or Google credentials and redirect you to the Klavena app.

FAQs

- Does it matter which Sign in method I use? Intuit or Google?

No, you can use either as long as you’re consistent with future sign ins.

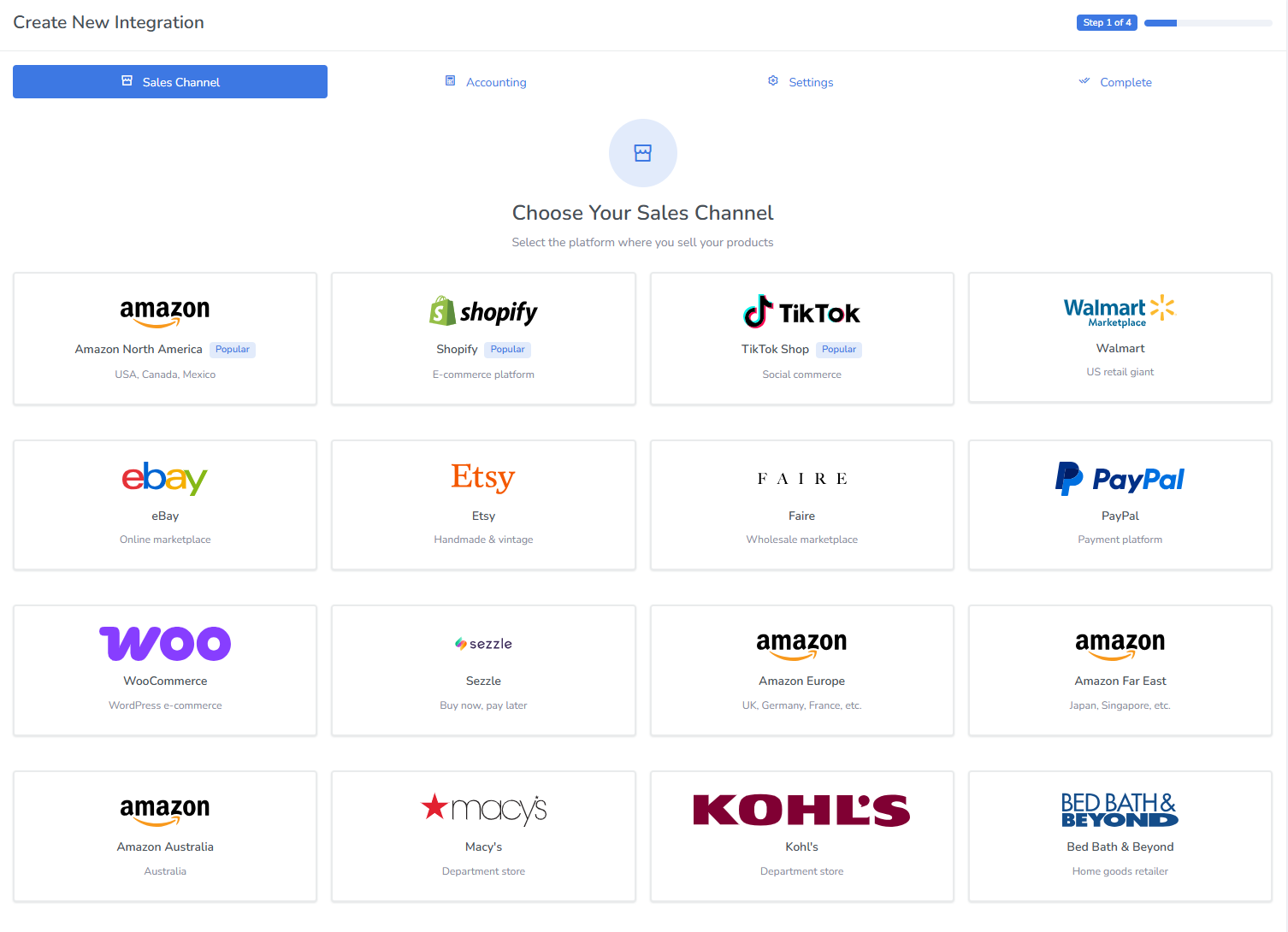

Select Sales Channel

Next, you will need to add your first integration before you can import data. Every integration comprises of a link between a sales channel and an accounting software.

With Klavena, here are the sales channels currently available:

- Amazon (all regions: North America, Europe, Far East, and Australia)

- Shopify

- Walmart

- PayPal

- eBay

- Etsy

- TikTok

- Faire

- WooCommerce

- Macys

- Kohls

- Bed Bath & Beyond

- Sezzle

Authorize Sales Channel

Depending on the sales channel, there will be a different authorization method to give permission for Klavena to access the sales channel's data. Below, we detail the methods for each sales channel:

OAuth redirect

For these sales channels, Klavena will redirect you to the sales channel's page to authorize permission.

- Amazon North America

- Amazon Europe

- Amazon Far East

- Amazon Australia

- Shopify

- Etsy

- eBay

- TikTok

- Faire

API Key

With the API Key authorization method, you will need to login to the sales channel backend, find the API Key in your settings, and copy/paste into Klavena's integration wizard.

- PayPal - How to Find Your PayPal API Keys

- Walmart - How to Find Your Walmart Marketplace API Keys

- WooCommerce - How to Find Your WooCommerce API Keys

- Sezzle - How to Find Your Sezzle API Keys

- Macys - How to Find Your Macy’s Marketplace API Key

- Kohls - How to Find Your Kohl’s Marketplace API Key

- Bed Bath & Beyond - How to Find Your Bed Bath & Beyond Marketplace API Key

For Shopify and WooCommerce, you'll need to enter information about your store.

- Shopify - How to Find Your Shopify Shop Name

- WooCommerce - How to Find Your WooCommerce Store URL

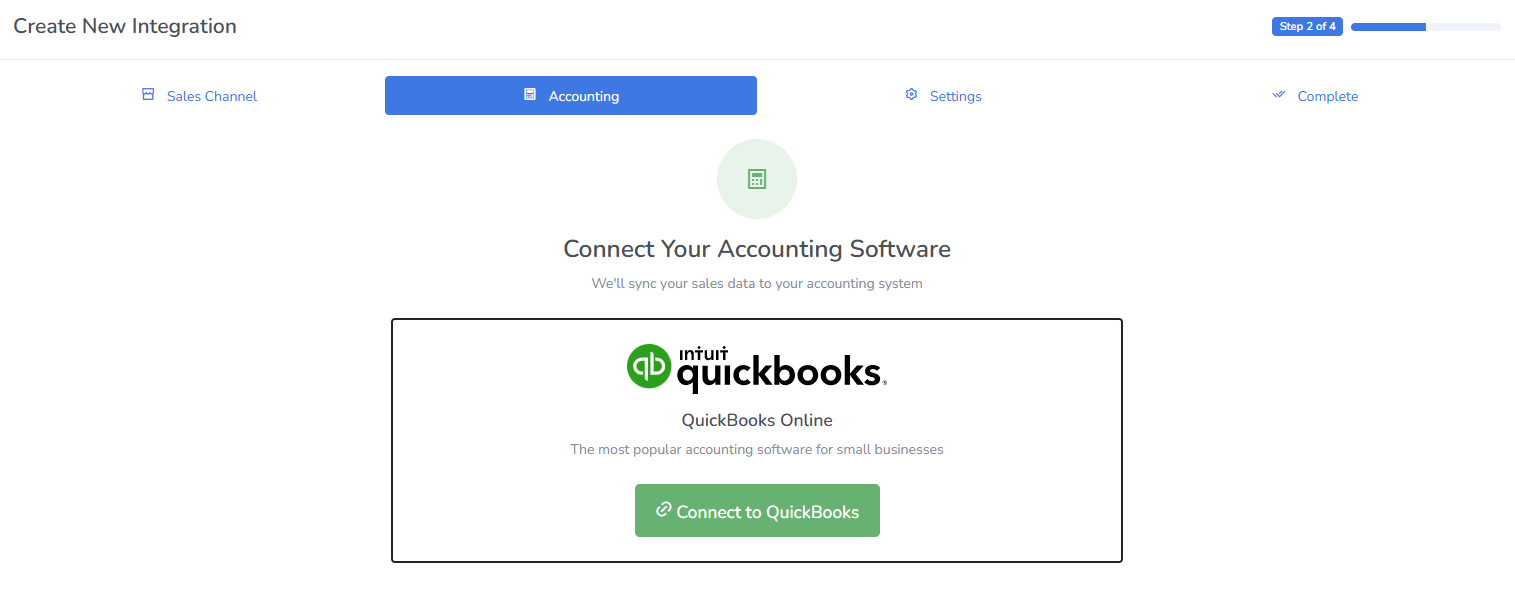

Select Accounting Software

Authorize Accounting Software

Then, click Continue and Authorize

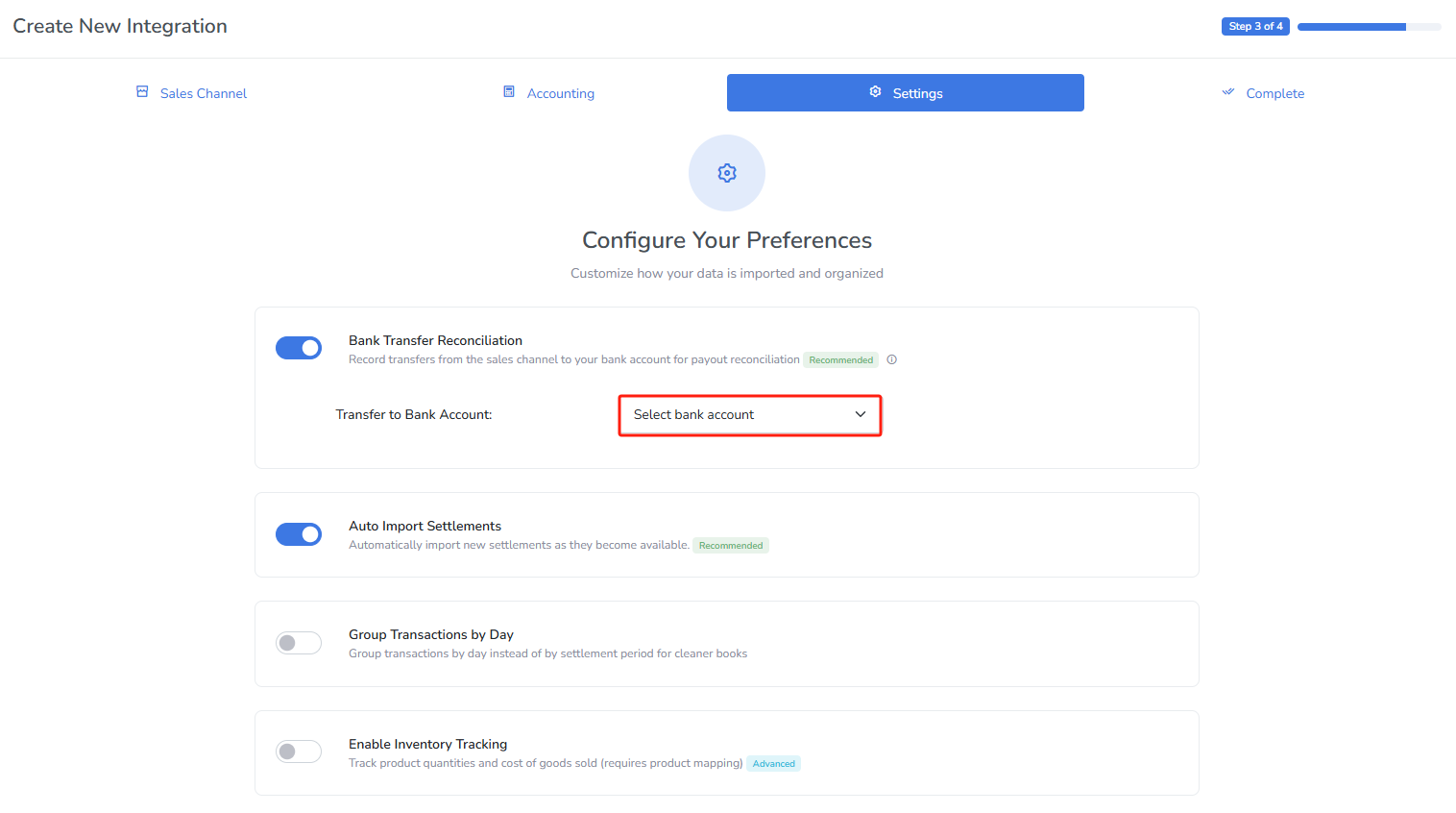

Settings

Keep the recommended settings, Bank Transfer Reconciliation is to match your bank deposits, and auto import is that future settlements will be imported automatically.

Choose the QuickBooks account that corresponds to the bank account where your sales channel deposits funds. If you haven't set up that bank account yet, you can always do it later! Simply uncheck Bank Transfer Reconciliation for now.

Inventory tracking is an advanced feature that helps you automatically calculate cost of goods sold (COGS). It requires some additional setup. You can find the inventory tracking at the bottom of this page.

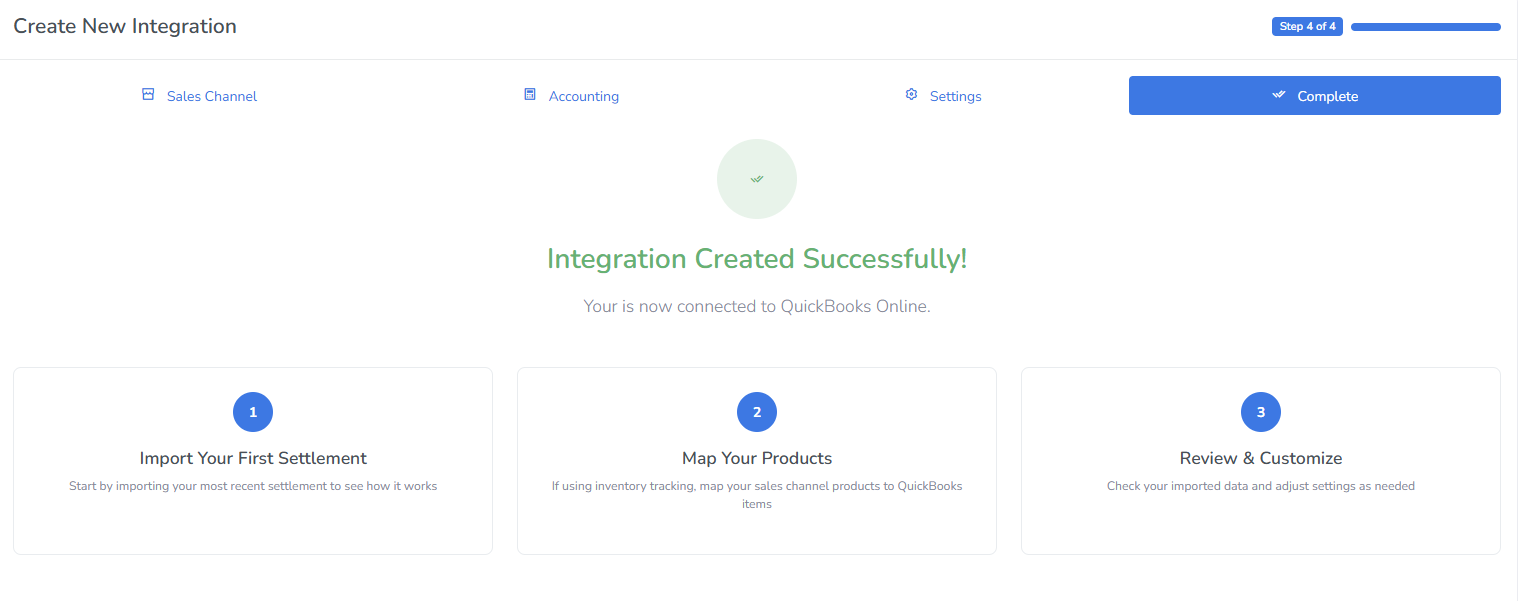

Finish Creating New Integration

This screen appears when your integration is completed successfully. We'll fetch some sales data in the background and set up your QuickBooks to ready for import.

After a few seconds, it should redirect the settlements page, where you see all your settlements or payouts!

Common Errors

- Error creating QuickBooks Online account: Business Validation Error: Multi Currency should be enabled to perform this operation How to Fix the Multi-Currency Business Validation Error in QuickBooks Online

- The Amazon API limits how many settlements you are allowed to download at a time. Please try again in 15 minutes. Amazon Settlement Download Limit: “Please Try Again in 15 Minutes”

- Troubleshooting & FAQs

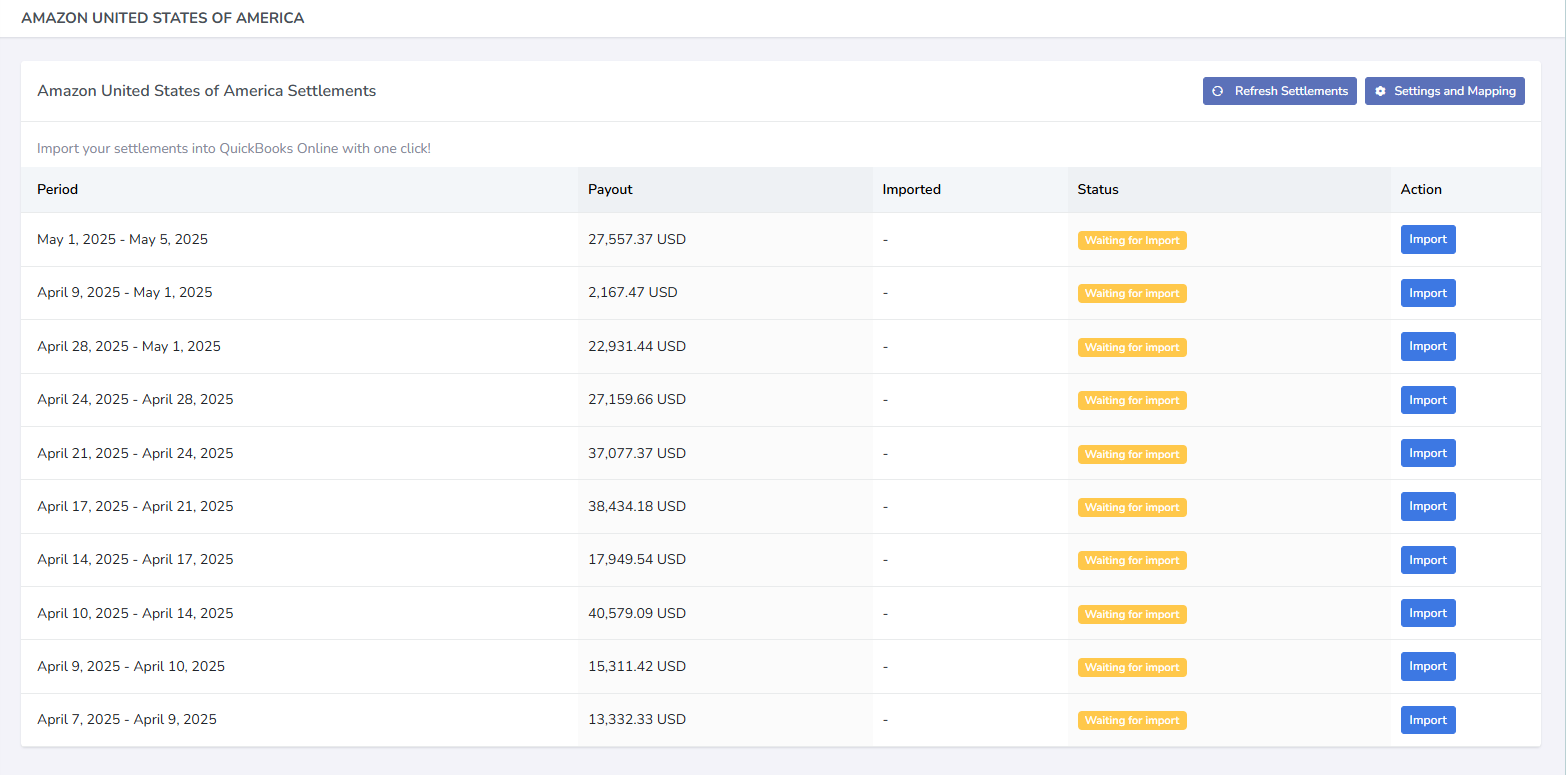

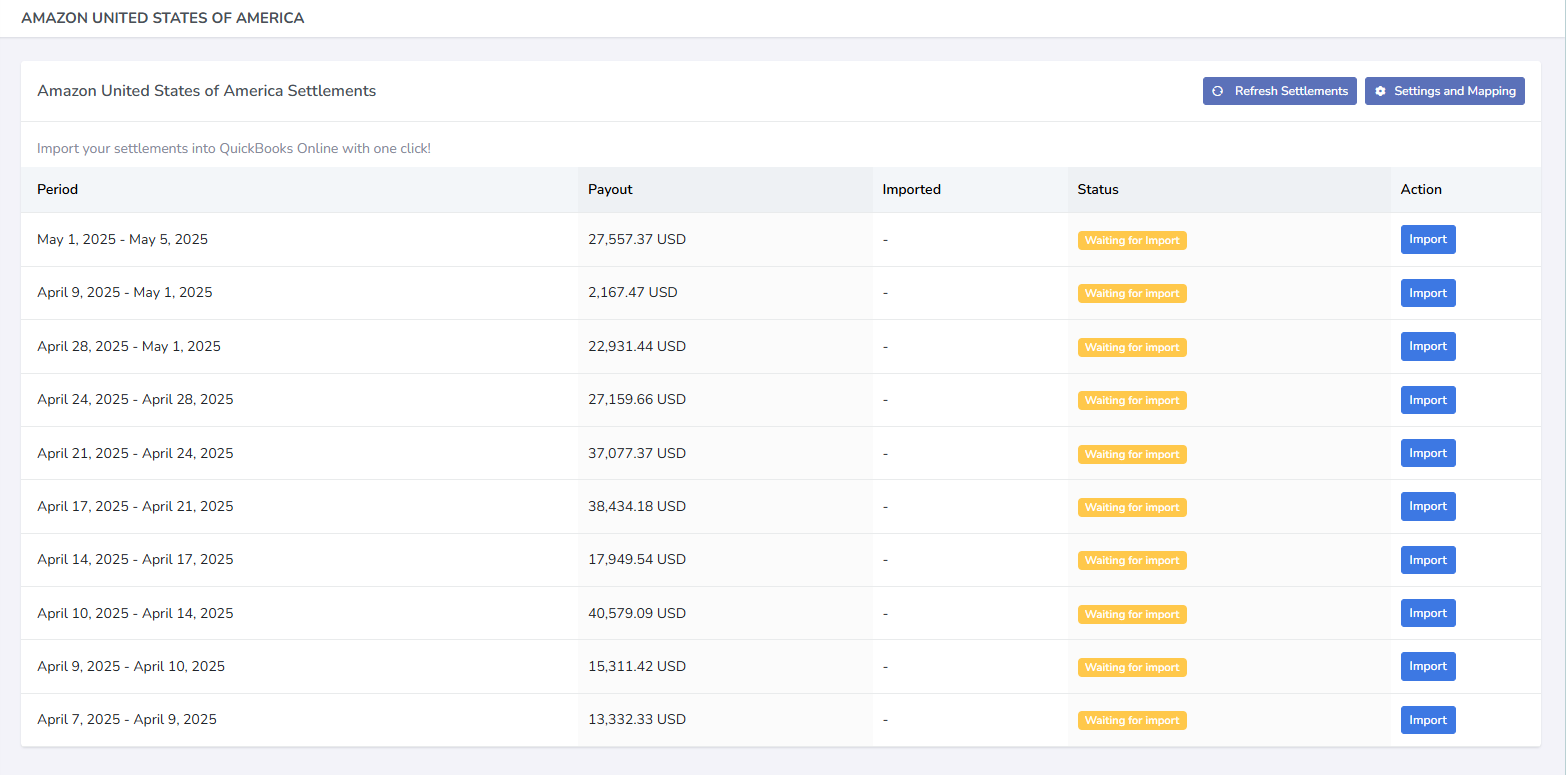

Import Settlement

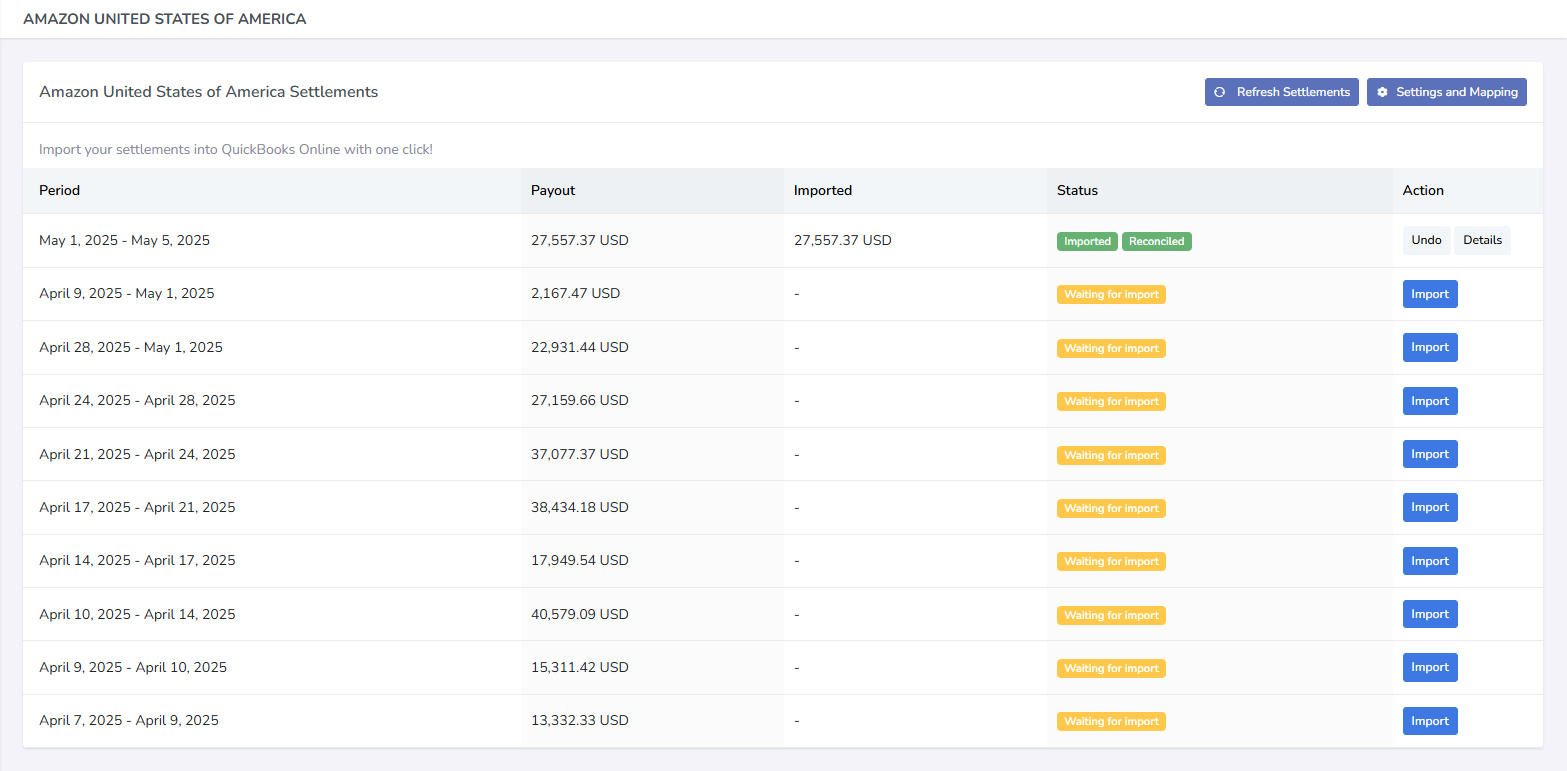

After you have created the new integration, it should redirect you to the integration's page, where you can see all of the settlements that are available to import.

You can click on import settlement button to import the settlement into QuickBooks Online.

Bank Transaction Reconciliation

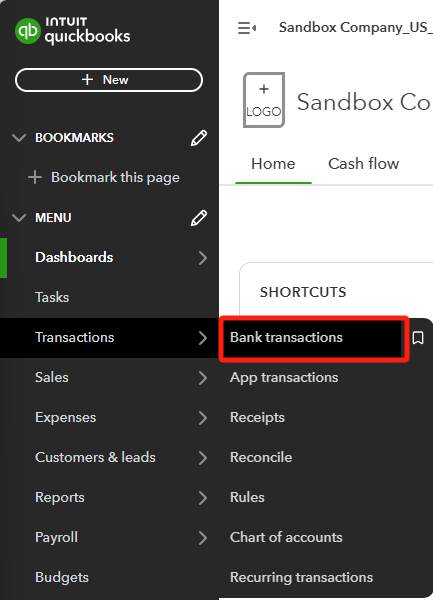

In the previous page, you clicked on import settlement button to import the settlement into QuickBooks Online. After it is imported, you can go ahead and reconcile this settlement by matching it within bank transactions in QuickBooks Online

Navigate to Bank Transactions

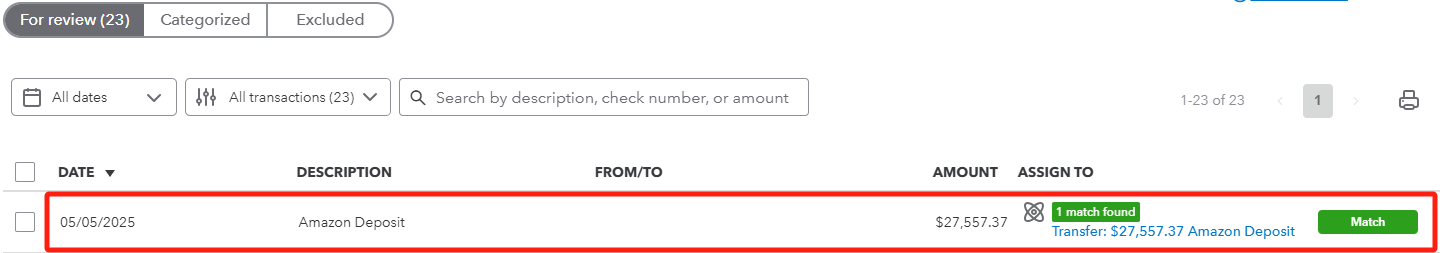

Match the Deposit

Under bank transactions, find the deposit from Amazon. It should be the same amount as the line in Klavena that you imported and click Match!

Verify that it's categorized

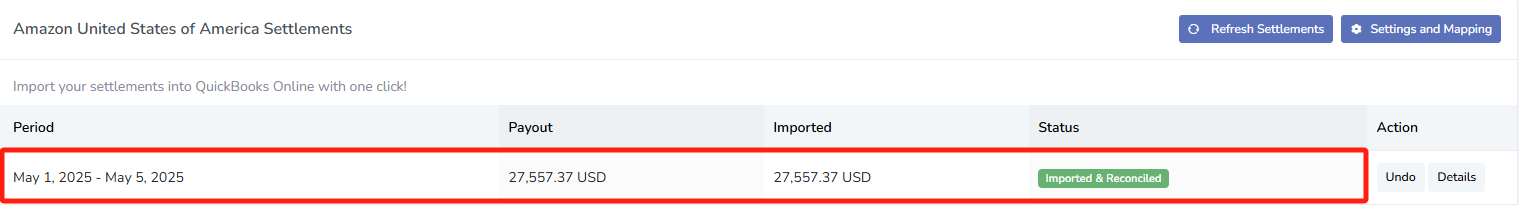

100% Reconciliation

Recall that this is the line that we imported. The imported amount matches the deposit amount in QuickBooks!

Congratulations!

You've linked your first sales channel to QuickBooks Online and imported and reconciled your first settlement.

Why Inventory Tracking Matters

With inventory tracking enabled, QuickBooks Online can calculate your cost of goods sold (COGS) every time a product is sold. Without inventory tracking, QuickBooks has no way of knowing how much each unit cost, which means your gross profit and financial reports will be incomplete.

By default:

- Without inventory tracking, Klavena assigns all sales and refunds to a generic non-inventory item named “Product.”

- With inventory tracking, Klavena maps each sale and refund to the specific inventory item in QuickBooks, allowing QuickBooks to reduce inventory levels and calculate COGS automatically.

How QuickBooks Calculates COGS (FIFO Method)

QuickBooks Online uses the First-In, First-Out (FIFO) method to track COGS. This means that the oldest inventory purchases are the first to be counted as sold. For each sale, QuickBooks reduces inventory and calculates the cost based on your earliest unsold inventory.

Klavena handles the sales side by creating sales receipts tied to inventory items. You are responsible for recording your purchase transactions in QuickBooks, so the system knows your inventory costs.

Feature Availability

Inventory tracking is only available on:

- QuickBooks Online Plus and Advanced plans

- The Klavena Professional plan

You must enable inventory tracking for each integration individually.

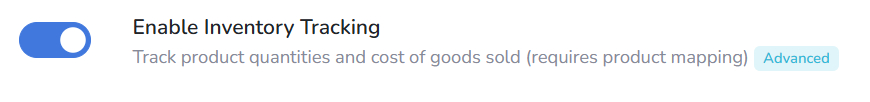

How to Enable Inventory Tracking

Step 1: Enable in Klavena

In the settings page of each integration, enable inventory tracking.

Navigate to Settings and Mappings.

Click Enable Inventory Tracking.

Step 2: Enable in QuickBooks Online

Go to QuickBooks → Settings → Account and Settings → Sales → and turn on Track quantity and price/rate and Track inventory quantity on hand

Mapping Error on Import

After enabling inventory tracking, your next settlement import may fail with a "mapping not found" error. This is expected until you map each sales channel product to its corresponding inventory item in QuickBooks.

Mapping Sales Channel Products to Inventory Items

- Create inventory items in QuickBooks (if not already created)

- Go to Products and Services.

- Click New and select Inventory.

- Enter the product Name (mandatory) and SKU (optional)

- Enter an Initial quantity on hand and the As of date (must be before your earliest sale).

- Save the item.

- Go to Products and Services.

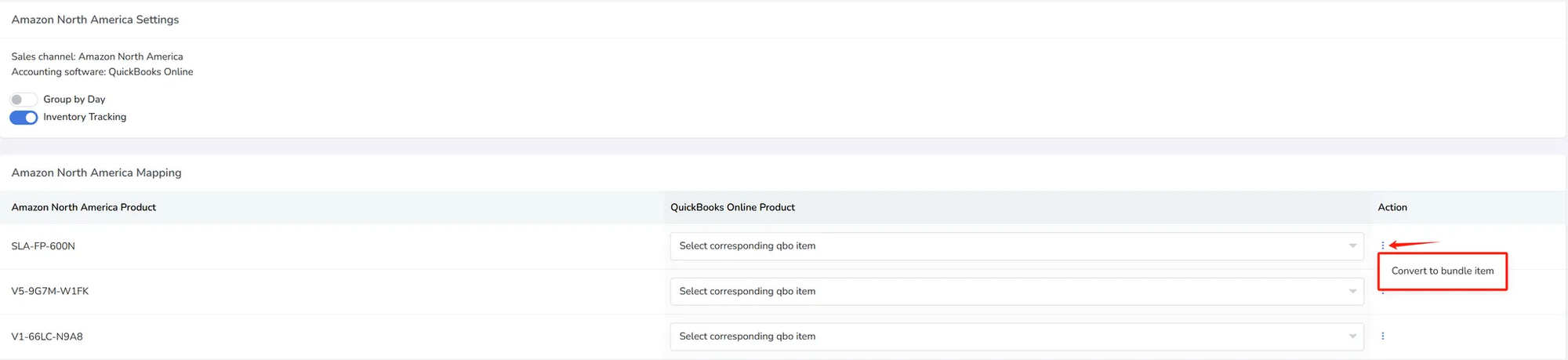

- Map products in Klavena.

- Return to the Mapping tab in Klavena’s integration settings.

- Match each product from your sales channel to the corresponding inventory item.

- Return to the Mapping tab in Klavena’s integration settings.

Bundles and Multipacks (optional)

If you sell bundles (e.g., a gift set with multiple SKUs) or multipacks (e.g. multiple of a single sku), you can break the bundle or multipack into its individual components and map each one in Klavena.

Here are some examples of situations in which you would want to use this feature.

- You sell a candle gift pack, containing 2 red candles, 2 green candles, and 2 blue candles, and you want to track the inventory and calculate cost of goods sold based on the individual red, green, and blue candles.

- Instead of selling 1 bottle of shampoo, you sell a multipack of 3 bottles of shampoo together, and you want to track the inventory and calculate cost of goods sold based on the individual bottle of shampoo.

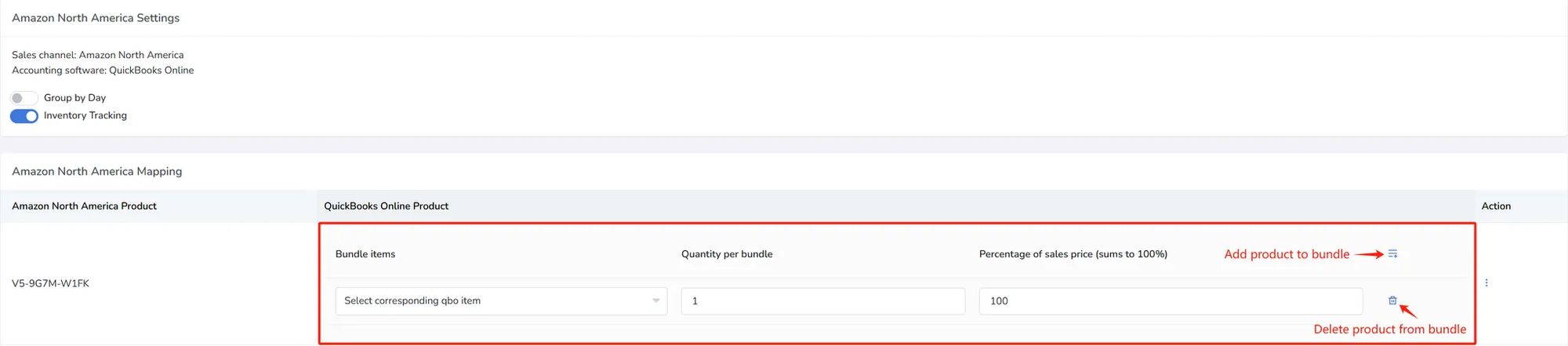

To convert a mapping entry into a bundle mapping entry, navigate to the action menu, and click on “Convert to bundle item”. Don’t worry, you can always convert back to the simple mapping by clicking the action button “Convert to inventory item”.

Next, you need to enter the following for your bundle or multipack:

- Bundle Item: The item within your bundle

- Quantity per bundle: Number of this item within your bundle

- Percentage of sales price: How much of the sales price should be allocated to this product within the bundle. This value must sum to 100 for all products.

Note: Percentage of cost is the total sales price allocated to that bundle item, not the unit sales price. For example: If 50% of sales price is allocated to this item, then no matter what the quantity per bundle is, that bundle item still gets 50% of sales price.

To add or remove objects from the bundle, you may click on the add or delete buttons on the right column.

Re-import the Settlement

After completing all mappings:

- Retry the previously failed import.

- Klavena will post sales receipts using the correct inventory items.

- QuickBooks will automatically reduce inventory and calculate COGS per sale.

Verifying Accuracy

After import:

- Open a recent sales receipt in QuickBooks to confirm it includes inventory items, not the generic "Product."

- Check your Profit & Loss and Balance Sheet reports — you should now see proper COGS and updated inventory asset balances.

Inventory Tracking Summary

- Inventory tracking is required for proper COGS reporting in QuickBooks.

- Klavena maps each transaction to inventory items so QuickBooks can perform FIFO-based COGS calculation.

- Setup involves enabling inventory tracking, creating inventory items, and mapping them properly.

- Bundles are supported either as single items or component SKUs.

Congratulations!

- You've linked your first sales channel to QuickBooks Online and imported and reconciled your first settlement.

- You've categorized the sales data and matched the bank deposit in the bank transactions to ensure accurate financial reporting.

- You've also potentially set up inventory tracking to have a better picture your inventory levels and COGS

- Great work!