What is E-commerce Accounting?

E-commerce accounting is the systematic recording, measuring, and communication of financial information for online businesses. Unlike traditional brick-and-mortar stores, e-commerce accounting involves unique challenges like:

- Multiple sales channels (Amazon, eBay, Shopify, Etsy)

- Digital payment processing (PayPal, Stripe, Amazon Pay)

- Complex fee structures (platform fees, payment processing, advertising)

- Inventory management across multiple locations

- International transactions and currency conversions

The Bottom Line

E-commerce accounting isn't just about tracking sales—it's about understanding your true profitability across all channels and making data-driven decisions to grow your business.

Pro Tip: Tools like Klavena automatically sync your sales data from multiple platforms directly into QuickBooks, eliminating manual data entry and reducing errors by up to 95%.

Why E-commerce Accounting is Different

1. Revenue Recognition Complexity

Unlike traditional retail, e-commerce revenue recognition involves:

- Marketplace fees deducted before you receive payment

- Refunds and returns processed weeks after the sale

- Subscription models with recurring revenue

- Multiple currencies for international sales

2. Multi-Channel Complexity

Managing finances across platforms means:

- Different payout schedules (Amazon bi-weekly, eBay daily, Shopify daily)

- Varying fee structures for each platform

- Platform-specific metrics that don't always align

- Consolidated reporting requirements for tax purposes

[Image Suggestion: Flowchart showing data from Amazon, eBay, Shopify flowing into Klavena, then into QuickBooks]

Essential E-commerce Accounting Concepts

1. Cost of Goods Sold (COGS)

COGS for e-commerce includes:

- Product cost from supplier

- Shipping to your warehouse (freight-in)

- Storage fees (FBA, 3PL)

- Direct labor for packaging/handling

Formula: COGS = Beginning Inventory + Purchases - Ending Inventory

2. Gross Profit Margin

Your gross profit margin shows profitability before operating expenses:

Formula: Gross Profit Margin = (Revenue - COGS) ÷ Revenue × 100

E-commerce Benchmark: Healthy e-commerce businesses typically maintain 40-60% gross margins.

3. Cash Flow vs. Profit

Critical Distinction: You can be profitable but cash-poor due to:

- Inventory purchases requiring upfront cash

- Platform payment delays (Amazon reserves, eBay holds)

- Seasonal fluctuations in sales

- Growth investments in inventory and marketing

Setting Up Your E-commerce Accounting System

Step 1: Choose Your Accounting Method

Accrual Basis Accounting (Recommended)

- Record transactions when they occur (regardless of payment)

- Best for: E-commerce businesses with inventory

- Pros: Shows true business performance, required for inventory

- Cons: More complex than cash basis

Why Accrual for E-commerce: With inventory, marketplace timing differences, and complex fee structures, accrual accounting provides a more accurate picture of your business performance.

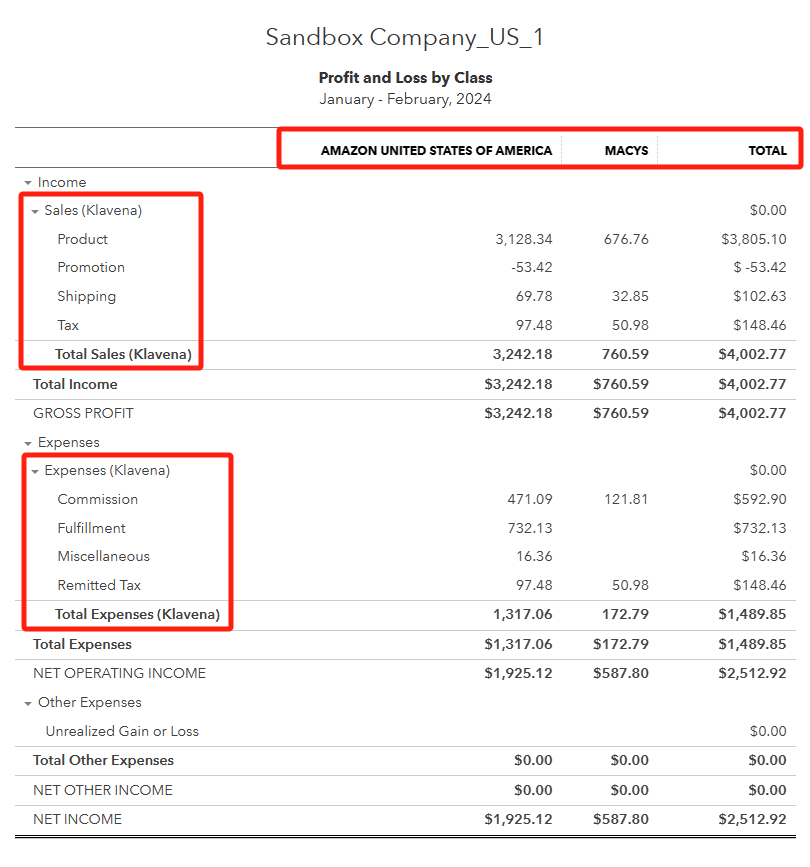

Step 2: Set Up Your Chart of Accounts (The Klavena Way)

Based on thousands of successful e-commerce integrations, Klavena automatically creates an optimized chart of accounts structure in QuickBooks:

Assets

- Bank Accounts

- Checking Account

- Savings Account

- Amazon Balance

- eBay Balance

- Shopify Balance

- Etsy Balance

- Other Assets

- Inventory Asset

- Prepaid Expenses

Income (Sales) - Organized by Platform

Sales (Klavena) - Main income account

- Product - Product sales across all platforms

- Shipping - Shipping charges collected

- Tax - Sales tax collected

- Promotion - Promotional credits/income

- Other - Miscellaneous income

For each marketplace (Amazon, eBay, Shopify, etc.), Klavena creates specific items like:

- Amazon Product

- Amazon Shipping

- eBay Product

- eBay Shipping

- And so on...

Cost of Goods Sold

- Cost of Goods Sold - Product costs and direct expenses

Expenses - Organized by Platform

Expenses (Klavena) - Main expense account

- Commission - Platform commission fees

- Fulfillment - FBA and fulfillment fees

- Storage - Storage and warehousing fees

- Advertising - Platform advertising costs

- Miscellaneous - Other platform-specific expenses

Liabilities

- Sales Tax Payable - By marketplace

- Amazon Sales Tax Payable

- eBay Sales Tax Payable

- Shopify Sales Tax Payable

- Accounts Payable

- Credit Cards

Why This Structure Works

- Platform Separation: Each marketplace has its own balance account and specific items

- Automated Categorization: Transactions automatically go to the right accounts

- Clean Reporting: Easy to see performance by platform

- Tax Compliance: Proper sales tax tracking by jurisdiction

- Scalability: Structure grows with your business

Step 3: Connect Your Sales Channels

Manual Method (Not Recommended):

- Download sales reports from each platform

- Import into QuickBooks monthly

- Time required: 4-8 hours per month

- Error risk: High (data entry mistakes, missed transactions)

Automated Method with Klavena:

- One-time setup connects all your sales channels

- Real-time synchronization of sales, fees, taxes, refunds

- Time required: 30 minutes setup, then automatic

- Error risk: Minimal (automated categorization, built-in validation)

What Klavena Automates:

- ✅ Sales receipts for each transaction

- ✅ Refund receipts for returns

- ✅ Expense categorization (fees, advertising, storage)

- ✅ Sales tax tracking by jurisdiction

- ✅ Inventory adjustments (if enabled)

- ✅ Bank transfers and deposits

Daily Accounting Tasks for Online Sellers

✅ With Klavena (5 minutes daily)

- Check dashboard for any sync alerts

- Review yesterday's performance across all platforms

- Monitor cash flow and upcoming payouts

- Check for any refunds or unusual transactions

✅ Manual Tasks (Still Required)

- Save receipts for business expenses

- Track mileage for business trips

- Document business meals and entertainment

- Record cash transactions immediately

🚫 Without Automation (60+ minutes daily)

- Download sales reports from each platform

- Manually enter transactions into QuickBooks

- Calculate and categorize fees

- Track refunds and adjustments

- Reconcile payment processor deposits

Monthly and Quarterly Responsibilities

📅 Monthly Tasks

Week 1: Review Automated Data

- Verify Klavena synchronization across all platforms

- Review automated categorizations for accuracy

- Check for any sync errors or missing data

- Reconcile bank accounts (much easier with automation!)

Week 2: Manual Adjustments

- Add manual expenses not captured automatically

- Record cash transactions and offline sales

- Adjust inventory if tracking manually

- Review and approve any flagged transactions

Week 3: Financial Analysis

- Generate P&L by platform using Klavena's reporting

- Analyze gross margins by product category

- Review cash flow and upcoming obligations

- Compare performance month-over-month

Week 4: Planning & Tax Prep

- Review sales tax obligations by state

- Plan inventory purchases based on cash flow

- Set aside tax payments (25-30% of profit)

- Update financial projections

📊 Quarterly Tasks

Financial Statements Review

With Klavena's automated data, your QuickBooks reports are always current:

- Profit & Loss by Platform - See which channels are most profitable

- Balance Sheet - Track assets, liabilities, and equity

- Cash Flow Statement - Understand money movement

- Sales Tax Reports - Ready for filing in each jurisdiction

Tax Planning

- Quarterly estimated payments (if required)

- Sales tax filings by state

- Review deductions and business expenses

- Plan year-end tax strategies

Tax Considerations for E-commerce

Sales Tax Compliance

E-commerce sales tax is complex, but Klavena helps by:

- Automatically tracking sales tax collected by platform

- Separating tax by jurisdiction for easy reporting

- Creating tax liability accounts for each marketplace

- Generating reports for tax filing

Income Tax Planning

Key Deductions for E-commerce:

- Product costs (COGS)

- Platform fees and commissions

- Advertising expenses

- Storage and fulfillment fees

- Home office expenses

- Business equipment and software (including Klavena!)

Quarterly Responsibilities

- Estimated tax payments (if self-employed)

- Sales tax filings in applicable states

- Payroll taxes (if you have employees)

- Review tax withholdings and adjust as needed

Common E-commerce Accounting Mistakes

1. Not Tracking Platform Fees Separately

Mistake: Recording gross sales without accounting for platform feesSolution: Klavena automatically separates fees from net sales

2. Mixing Personal and Business Expenses

Mistake: Using personal accounts for business transactions

Solution: Dedicated business accounts for each platform

3. Ignoring Sales Tax Obligations

Mistake: Not collecting or remitting sales tax properly

Solution: Automated sales tax tracking by jurisdiction

4. Poor Inventory Management

Mistake: Not tracking COGS accurately

Solution: Proper inventory accounting (Klavena can help with this too)

5. Manual Data Entry Errors

Mistake: Relying on manual entry from multiple platformsSolution: Automated synchronization eliminates 95% of data entry errors

Choosing the Right Accounting Software

QuickBooks Online (Recommended for E-commerce)

Pros:

- Industry standard for small businesses

- Excellent integration capabilities

- Robust reporting features

- Works seamlessly with Klavena

Cons:

- Monthly subscription cost

- Learning curve for beginners

Why QuickBooks + Klavena is the Winning Combination

- QuickBooks provides the accounting foundation

- Klavena handles the e-commerce complexity

- Together they create a complete solution that scales with your business

Alternative Options:

- Xero: Good alternative to QuickBooks

- Wave: Free option for very small businesses

- FreshBooks: Better for service businesses

When to Hire a Professional

DIY with Klavena (Up to $500K revenue)

- Automated data sync handles most complexity

- Built-in categorization reduces errors

- Clean reports make tax prep easier

- Cost-effective for growing businesses

Consider a Bookkeeper ($500K - $2M revenue)

- Monthly reconciliation and review

- Advanced financial analysis

- Tax planning and preparation

- Klavena makes their job easier and more accurate

Hire a CPA ($2M+ revenue)

- Strategic tax planning

- Advanced business structuring

- Audit preparation

- Financial forecasting and analysis

Getting Started: Your 30-Day Action Plan

Week 1: Foundation

- [ ] Open dedicated business bank accounts

- [ ] Sign up for QuickBooks Online

- [ ] Connect Klavena to your sales channels

- [ ] Let Klavena create your chart of accounts

Week 2: Automation

- [ ] Verify all platforms are syncing correctly

- [ ] Review automated categorizations

- [ ] Set up sales tax tracking

- [ ] Configure inventory settings (if applicable)

Week 3: Analysis

- [ ] Generate your first automated P&L report

- [ ] Review performance by platform

- [ ] Identify top products and profit margins

- [ ] Set up monthly reporting schedule

Week 4: Optimization

- [ ] Fine-tune account mappings if needed

- [ ] Set up automated reports

- [ ] Plan tax strategy

- [ ] Schedule monthly review process

Conclusion

E-commerce accounting doesn't have to be overwhelming. With the right structure and tools like Klavena, you can:

✅ Automate 95% of data entry across all sales channels

✅ Maintain accurate financial records in real-time

✅ Generate professional reports for taxes and analysis

✅ Scale your accounting as your business grows

✅ Focus on growing your business instead of managing spreadsheets

Ready to streamline your e-commerce accounting? Try Klavena free for 14 days and see how automation can transform your business finances.

Frequently Asked Questions

Q: Can I use cash basis accounting for my e-commerce business?

A: While possible for very small businesses, accrual accounting is recommended for e-commerce due to inventory requirements and timing differences between sales and payments.

Q: How often should I reconcile my accounts?

A: Monthly reconciliation is standard, but with Klavena's real-time sync, your data is always current, making reconciliation much faster.

Q: Do I need separate accounts for each sales channel?

A: Klavena creates separate balance accounts for each platform automatically, which helps with cash flow management and platform-specific analysis.

Q: What's the biggest mistake new e-commerce sellers make?

A: Not setting up proper accounting from the start. Manual processes that work at $10K/month become impossible at $100K/month.

Q: How much should I set aside for taxes?

A: Generally 25-30% of profit for federal and state taxes, plus sales tax obligations. Klavena's reporting makes it easy to calculate these amounts.

Want to see how Klavena can simplify your e-commerce accounting? Sign up with Klavena and discover why thousands of sellers trust Klavena to manage their multi-channel finances.